GAITHERSBURG, Md. and MORRISVILLE, N.C., July 23, 2020 (GLOBE NEWSWIRE) — Novavax, Inc. (NASDAQ: NVAX), a late-stage biotechnology company developing next-generation vaccines for serious infectious diseases, and FUJIFILM Diosynth Biotechnologies (FDB), a world leading contract development and manufacturing organization (CDMO) for biologics, viral vaccines and gene therapies, announced today an agreement to manufacture bulk drug substance for NVX-CoV2373, Novavax’ COVID-19 vaccine candidate. FDB’s site in Morrisville, North Carolina has begun production of the first batch of NVX-CoV2373.

This arrangement falls under Novavax’ recent $1.6 billion award by the federal government as part of Operation Warp Speed (OWS), a U.S. government program that aims to begin delivering millions of doses of a safe, effective vaccine for COVID-19 to the U.S. population. The OWS funding is being used by Novavax to complete late-stage clinical development, including a pivotal Phase 3 clinical trial; establish large-scale manufacturing; and deliver 100 million doses of NVX‑CoV2373 beginning as early as late 2020. NVX-CoV2373 consists of a stable, prefusion protein made using Novavax’ proprietary nanoparticle technology and includes Novavax’ proprietary Matrix‑M™ adjuvant. The batches produced at the FDB site in North Carolina will be utilized in a future pivotal Phase 3 clinical trial of up to 30,000 subjects which is expected to begin in the fall of 2020 and which will determine the safety and efficacy of NVX-CoV2373.

“We are grateful to partner with the team at FUJIFILM Diosynth Biotechnologies to ensure the large-scale manufacture of our COVID-19 vaccine candidate,” said Stanley C. Erck, President and Chief Executive Officer of Novavax. “We are committed to working together with unprecedented speed to deliver a vaccine to protect our nation’s population.”

“We are delighted to bring our leading technical expertise in baculovirus systems and our proven manufacturing excellence to support Novavax’ response to this global crisis,” said Martin Meeson, Chief Executive Officer of FUJIFILM Diosynth Biotechnologies. “As a critical partner to Novavax, our focus is to advance the delivery of a vaccine that can have a profound impact.”

Novavax’ Phase 1/2 clinical trial of NVX-CoV2373 in 130 healthy participants 18 to 59 years of age began in Australia in May. Novavax will announce the Phase 1 data, which will consist of preliminary immunogenicity and safety results, during the first week of August. The Phase 2 portion to assess immunity, safety, and COVID-19 disease reduction is expected to begin shortly thereafter. The Phase 1/2 clinical trial is being supported by an up-to $388 million funding arrangement with the Coalition for Epidemic Preparedness Innovations (CEPI).

For further information, including media-ready images, b-roll, downloadable resources and more, click here.

About Operation Warp Speed

Operation Warp Speed is facilitating, at an unprecedented pace, the development, manufacturing, and distribution of COVID-19 countermeasures, between components of Department of Health and Human Services (HHS), including the Centers for Disease Control and Prevention (CDC), FDA, the National Institutes of Health (NIH), and the Biomedical Advanced Research and Development Authority (BARDA, part of the HHS Office of the Assistant Secretary for Preparedness and Response); the Department of Defense. OWS is coordinating existing HHS-wide efforts, including the NIH’s ACTIV partnership for vaccine and therapeutic development, NIH’s RADx initiative for diagnostic development, and work by BARDA.

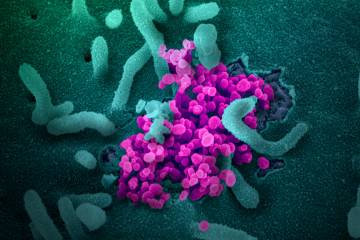

About NVX-CoV2373

NVX‑CoV2373 is a vaccine candidate engineered from the genetic sequence of SARS‑CoV‑2, the virus that causes COVID-19 disease. NVX‑CoV2373 was created using Novavax’ recombinant nanoparticle technology to generate antigen derived from the coronavirus spike (S) protein and contains Novavax’ patented saponin-based Matrix-M™ adjuvant to enhance the immune response and stimulate high levels of neutralizing antibodies. In preclinical trials, NVX‑CoV2373 demonstrated indication of antibodies that block binding of spike protein to receptors targeted by the virus, a critical aspect for effective vaccine protection. A Phase 1 clinical trial of NVX‑CoV2373 initiated in May 2020, with preliminary immunogenicity and safety results expected to be announced during the first week of August. The Coalition for Epidemic Preparedness Innovations (CEPI) is investing up to $388 million, and Department of Defense (DoD) is investing up to $60 million of funding to advance clinical development of NVX‑CoV2373.

About Matrix-M™

Novavax’ patented saponin-based Matrix-M™ adjuvant has demonstrated a potent and well-tolerated effect by stimulating the entry of antigen-presenting cells into the injection site and enhancing antigen presentation in local lymph nodes, boosting immune response.

About Novavax

Novavax, Inc. (Nasdaq:NVAX) is a late-stage biotechnology company that promotes improved health globally through the discovery, development, and commercialization of innovative vaccines to prevent serious infectious diseases. Novavax recently initiated development of NVX-CoV2373, its vaccine candidate against SARS-CoV-2, the virus that causes COVID-19, with preliminary immunogenicity and safety results expected to be announced during the first week of August. NanoFlu™, its quadrivalent influenza nanoparticle vaccine, met all primary objectives in its pivotal Phase 3 clinical trial in older adults. Both vaccine candidates incorporate Novavax’ proprietary saponin-based Matrix-M™ adjuvant in order to enhance the immune response and stimulate high levels of neutralizing antibodies. Novavax is a leading innovator of recombinant vaccines; its proprietary recombinant technology platform combines the power and speed of genetic engineering to efficiently produce highly immunogenic nanoparticles in order to address urgent global health needs.

For more information, visit www.novavax.com and connect with us on Twitter and LinkedIn.

About FUJIFILM

FUJIFILM Diosynth Biotechnologies is an industry-leading Biologics Contract Development and Manufacturing Organization (CDMO) with locations in Teesside, UK, RTP, North Carolina, College Station, Texas and Hillerød, Denmark. FUJIFILM Diosynth Biotechnologies has over thirty years of experience in the development and manufacturing of recombinant proteins, vaccines, monoclonal antibodies, among other large molecules, viral products and medical countermeasures expressed in a wide array of microbial, mammalian, and host/virus systems. The company offers a comprehensive list of services from cell line development using its proprietary pAVEway™ microbial and Apollo™X cell line systems to process development, analytical development, clinical and FDA-approved commercial manufacturing. FUJIFILM Diosynth Biotechnologies is a partnership between FUJIFILM Corporation and Mitsubishi Corporation. For more information, go to: www.fujifilmdiosynth.com

FUJIFILM Holdings Corporation, Tokyo, Japan, brings cutting edge solutions to a broad range of global industries by leveraging its depth of knowledge and fundamental technologies developed in its relentless pursuit of innovation. Its proprietary core technologies contribute to the various fields including healthcare, graphic systems, highly functional materials, optical devices, digital imaging and document products. These products and services are based on its extensive portfolio of chemical, mechanical, optical, electronic and imaging technologies. For the year ended March 31, 2020, the company had global revenues of $21 billion, at an exchange rate of 109 yen to the dollar. Fujifilm is committed to responsible environmental stewardship and good corporate citizenship. For more information, please visit: www.fujifilmholdings.com

Forward-Looking Statements

Statements herein relating to the future of Novavax and the ongoing development of its vaccine and adjuvant products, including statements regarding the manufacturing of vaccine antigen dose amounts and timing, are forward-looking statements. Novavax cautions that these forward-looking statements are subject to numerous risks and uncertainties, which could cause actual results to differ materially from those expressed or implied by such statements. These risks and uncertainties include those identified under the heading “Risk Factors” in the Novavax Annual Report on Form 10-K for the year ended December 31, 2019, as filed with the Securities and Exchange Commission (SEC) and updated by any Quarterly Report on Form 10-Q, particularly the risks inherent to developing novel vaccines. We caution investors not to place considerable reliance on the forward-looking statements contained in this press release. You are encouraged to read our filings with the SEC, available at sec.gov, for a discussion of these and other risks and uncertainties. The forward-looking statements in this press release speak only as of the date of this document, and we undertake no obligation to update or revise any of the statements. Our business is subject to substantial risks and uncertainties, including those referenced above. Investors, potential investors, and others should give careful consideration to these risks and uncertainties.

Contacts:

Investors and Media

Silvia Taylor and Erika Trahan

ir@novavax.com

240-268-2022

Media

Brandzone/KOGS Communication

Edna Kaplan

kaplan@kogspr.com

617-974-8659

Joe Metzger

Joseph.metzger@fujifilm.com

978-273-5187

Liza M. Rivera

Liza.rivera@fujifilm.com

919-325-6972